Earlier this year, American Airlines CEO Doug Parker told investors that he did not believe the airline industry would continue to see losses: “We, like other businesses will have good years and bad years, but the bad years will not be cataclysmic. They will just be less good than the good years.” He expressed a similar sentiment following the release of recent 3rd-quarter earnings. This positive outlook is a shift from traditional beliefs, which decry the inability for airlines to be profitable. This has led many outsiders to ask the question: How have airlines overcome the financial hurdles that previously held them back (and where do aircraft parts suppliers fit in)?

The Rise of Budget Airlines

Analysts of the industry describe that one of the biggest cuts to past profits has been the introduction of low-cost carriers like JetBlue and Southwest. As researchers have found, the majority of flyers base purchasing decisions on one factor: price. This has led larger airlines and smaller carriers to compete heavily for customers—driving down fares and, ultimately, profits. As Richard Branson famously stated, “If you want to be a millionaire, start with a billion dollars and launch a new airline.” However, major airlines may have recently found a way to fight these price wars.

Earlier this year, Delta introduced its “basic economy” fares—a bare bones offering with no advanced seat assignments, no possibility for free upgrades and the inability to change or cancel a flight. This model earned Delta roughly $20 million in additional sales during its first quarter introduction, and the airline is working to expand offerings to further markets. Rather than create new, budget ventures (as many airlines, including Delta, attempted in the ‘90s), this strategy simply lumps economy and high-spending customers all on the same plane, albeit with different flying experiences.

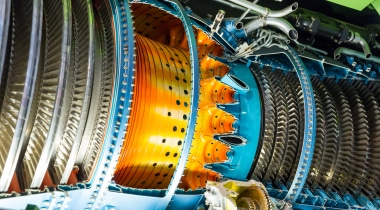

Impacts of Fluctuating Fuel Costs

In 2008, the global airline industry sustained losses of $5.8 billion, with the cost of oil nearly doubled compared to 2007. Couple that with a decrease in demand due to a global economic downturn and some airlines were faced with near insolvency (in fact, American Airlines specifically warned shareholders of this possibility). Luckily, most airlines have recovered since this period and, as a result, have taken steps to cushion potential spikes in the cost of fuel.

One of the ways airlines are working to combat fuel costs is through increased efficiencies across the board. A big example of this is through the implementation of “rightsizing” (the constant reorganization of fleets to meet demand fluctuations). This means that, when travel demands are low, airlines utilize smaller, fuel-efficient jets versus the larger aircraft for busier seasons (like the holidays). And with oil prices rumored to drastically increase next year, efficiencies like rightsizing should help hedge losses.

Takeoff Delays

There is an array of costs associated with a sidelined aircraft. Grounded planes can lead to major disruptions in flight plans, cancelled fares and other losses. In fact, the storage fees for planes that are kept out of service for more than a few hours can cost nearly $17,100 a day. This means that MROs must meet strict turnaround times when servicing aircrafts. If delays are incurred due to missteps in the supply chain or inaccuracies given by aircraft parts suppliers, airlines directly see the financial effects.

One way MROs can help airlines remain competitive and profitable is by relying on trusted aircraft parts suppliers. At Kapco Global, we’ve worked to simplify the purchasing process and drive operational efficiency for those facing pressing timelines. Whether resolving an AOG, minimizing aircraft downtime or reducing MRO turn-times, ‘time’ matters. Through our industry-leading e-commerce platform, Kapco kart, our customers can view real-time inventory levels, see arrival dates for out-of-stock parts and track shipments from any of our global stocking locations. As we’ve seen firsthand, the benefits of well-stocked products and on-time delivery means increased operational agility and better supported MROs and, ultimately, more profitable airlines.

More from the Kapco Global Blog

Cyber Security and Other Methods of Protection Against Aircraft Hacking

MRO Strategies for Tackling “Rightsizing” Within the Aviation Industry