The cost of oil has the potential to play a very large role in all of our daily lives, influencing everything from personal finances to the performance of global economies. For the last several years, we have seen a rapid decrease in jet fuel price, with barrel figures returning to lows reminiscent of the 1990s. However, these deep discounts on fuel prices may be nearing an end.

Overall, our projections indicate that U.S. oil and gas capital expenditure will rebound from a Covid-19-induced low of $91 billion in 2020 and an expected $99.3 billion this year to over $112.7 billion in 2023 and 2024.” The estimated price fluctuations raise two big questions to those in the aerospace industry:

1). What factors are projected to contribute to the aviation fuel price spike?

and

2). How will an increase in aviation fuel prices ultimately affect aerospace?

What Does Jet Fuel Currently Cost

Depending on the region in the United States, jet fuel prices can fluctuate around $4 a gallon. In 2021, jet fuel prices reached an average high in Alaska at $6.57 for JetA and $7.42 for 100LL and reached an average low in the central United States at $4.43 for JetA and $5.08 for 100LL. Other areas in the United States fall in between those two metrics, though generally having prices that mirror closer to the central United States than Alaska.

Global Factors Contributing to Current Low Prices

To understand the projected aviation fuel price spike, it is essential to have a grasp on the global affairs that have kept barrel prices low. According to The New York Times, these price trends are directly related to the industry’s massive surplus. Canada, Iraq and Russia have seen drastic increases in production, and an end to sanctions on Iran has contributed to an influx of oil by the country. Meanwhile, the United States has nearly doubled its oil production thanks to the use of fracking technology, and OPEC has done little to limit oil surpluses due to economic competition between the feuding countries of Saudi Arabia and Iran, all of which has forced oil-reliant nations facing economic hardships, like Venezuela, Nigeria, Ecuador and Brazil, to keep prices competitively low. However, this oil surplus has begun to slow.

Reasons for Projected Fuel Price Spikes

As economists explain, low barrel prices eventually equate to a drop in oil production. The reasons are clear: When oil becomes less profitable, companies cannot continue expanded extraction efforts. These slows have already started, with the U.S. beginning to see a small decline in domestic oil production versus last year and OPEC threatening to pull back supplies soon.

For other oil producers, sustaining record lows comes at a cost that cannot be continued. In Venezuela, Nigeria, Ecuador and Brazil, economic and political turbulence may soon limit oil surpluses. As CNN Money reports, Venezuela oil production has recently staggered with major oil operators Halliburton and Schlumberger planning to end operations in the country due to outstanding debts. And Nigeria has already seen drops in production due to militancy resulting in an unstable political climate. Both situations are detrimental to low fuel prices.

The Impact of Aviation Fuel Prices on the Aerospace Industry

As aviation fuel prices rise, airlines must adjust their budgets accordingly; with more funding funneled toward gas, less is available for overall growth. One of the benefits of the drop in oil prices for airlines has been the ability to regain ground following major upsets (like profit losses following 9/11 and the 2008 recession). Expensive operation costs due to a spike in oil would have a direct impact on the continued growth of airlines. But this isn’t the only area of business that increased oil costs will influence.

In a similar vein, a rise in oil prices has played a historic part in economic recessions. As the cost of daily necessities (which for many means fuel) rise, extras, like vacations involving airports for air travel, are sacrificed. Thus, airlines may end up paying more for flight fuel with fewer passengers per flight. And that means further cuts to profits.

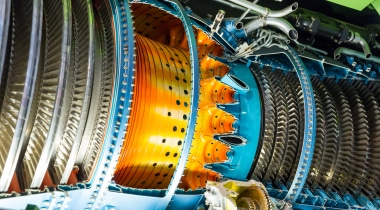

Of note, one positive side effect due to an increase in aviation fuel prices has been the resulting advancements to ecological considerations. Airline demands resulting from high fuel costs in the early 2000s have been partially responsible for ecological strides, like Boeing’s 737 MAX and the ecoDemonstrator 757. With more fuel-efficient jet aircraft now available to airlines, spikes in fuel prices may cut into profits less than they have historically.

Read More from the Kapco Global Blog

Factors Involved in Fleet Retirement and Aircraft Recycling

Lean Manufacturing in the Aviation Industry

Efficiency in Aviation—What the Aerospace Industry Is Doing Right Now to Help Curb Global Warming