COVID-19 has had an enormous impact on the aviation industry, but it goes far beyond canceled flights and empty airports. As airplanes are grounded and the number of passengers on each flight continues to remain low, every corner of the industry is affected. In fact, according to Aviation Analysis Firm Oliver Wyman, domestic travel revenue isn’t expected to return to 2019 levels until the second half of 2022, with international travel revenue not expected to get back to its 2019 level until 2023.

COVID-19’s Impact on the MRO Industry

One of the corners of the industry that has been gut-punched by the pandemic is the MRO (Maintenance, Repair, and Overhaul) sector. Instead of buying used parts to fix older aircraft and extend their lifespan, airline companies are choosing to retire planes altogether due to a higher than usual number of parked planes. For example, Delta Airlines will be retiring its entire fleet of Boeing 777s by the end of the year. These retirements have really impacted the MRO sector. In fact, MRO companies are projected to lose about 45% of their expected revenue this year. However, while the numbers may look dire, MRO companies are actually projected to be one of the first aircraft sectors to start recovering economically.

The question for both manufacturers and MRO companies is when they will see an uptick in orders and therefore revenue post-COVID-19. The assumption is that airplane manufacturers such as Boeing and Airbus will probably not see much of an increase in demand because of the airlines’ desire to save money after the huge losses they’ve taken. Instead, expect to see sudden growth for MRO companies.

Large Used Parts Inventory Available

While plane retirements have temporarily grounded the MRO sector, they will actually play a huge role in their return to pre-COVID revenue levels. Retired planes are extremely valuable to USM (Used Serviceable Materials) companies because they are full of serviceable used parts available to salvage. Not only that, but as airline companies slowly start to add flights and get back to their pre-COVID-19 schedules, they are going to need more of their planes. More planes in the air inevitably means more planes that need maintenance. Repairing existing planes, rather than buying new ones, will be key as airline companies try to save money. They may also turn to parts that make their airplanes COVID-19 safe. For example, as airlines worry about recycled air on their planes, HEPA filters could become a must. While repairing and updating planes will help the MRO sector as a whole, USM companies stand to benefit the most from these money-saving efforts, and Proponent is here to help.

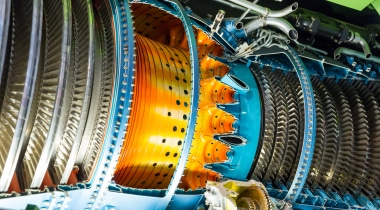

Green-Time Engines

While plane repairs can be as cheap and simple as repairing a battery, they can get expensive quickly. This is especially true when complex parts like the engine break down. Through borescope inspections, however, mechanics can quickly evaluate where the issue is located, and if the problem is worth fixing. As airlines try to save money, repairing airplane engines may be out of the question. That’s why maybe the biggest way USM companies can benefit is by harvesting engines from newly retired planes. With as many as 17,000 planes grounded worldwide because of COVID-19, airline companies will start to retire younger planes to cut storage and maintenance costs on planes that aren’t being used. This means that instead of choosing to pay for expensive engine rebuilds, airline companies will choose instead to just replace old engines with ones from retired planes that still have miles left on them. There’s a good chance that these engines, called green-time engines because of the good miles they have left, will be in high demand as the airline companies get back up and going. With so many planes being retired before they otherwise would have been, that demand will be matched by a huge increase in green-time engines that can be sold by USM companies.

Being able to salvage and use these green-time engines will buoy up both airline companies and companies who maintain the green-time engine inventories. The problem with these engines is that they won’t last more than a year or two, meaning that OEMs, (Original Equipment Manufacturers) need to be proactive in planning for that eventuality.

What this means for both MRO companies

MRO companies, especially USM companies, need to plan for the future right now. Despite all the uncertainties caused by COVID-19, airline companies will eventually start putting more planes in the air as they ramp back up to their pre-pandemic levels. Once this happens, expect the market on used parts and green-time engines to rise rapidly. It is best to plan for this now by making used parts available and retiring planes only as needed.

MRO companies can’t just sit back and expect to fully reap the benefits. Expect OEM companies to jump into the market quickly in an attempt to buy up many of the newly available used parts. With revenue down so far for everyone, both sectors of the industry will be desperate to capture a piece of the market. Companies who plan now for this eventuality will be rewarded with an important revenue stream.