One of Kapco Global’s most popular stories in 2015 was our Commercial Aviation Growth Outlook blog. Now that 2016 is underway, we look forward to what this new year will bring. Overall, experts and forecasters are anticipating a strong year for growth and profits in 2016 commercial aviation.

Low Oil Prices Will Continue to Foster Growth

The International Air Transportation Association (IATA) reports that the airline industry in 2016 can expect a 5.1% net profit margin, up from 4.6% in 2015. The leading factor driving these profits is the ongoing depression in the oil markets. The U.S. Energy Information Administration in their January Short-Term Energy Outlook projects that Brent crude oil will average $40 a barrel through 2016, moving up to $50 a barrel in 2017.

The IATA also reports that demand for passenger travel is expected to grow by 6.9% in 2016, which will offset weak growth in cargo. A U.S. News investing report for the travel sector attributes the increase in passenger travel to low oil prices and a strengthening economy, but they also suggest that margins may have peaked, with experts citing less revenue per mile as capacity increases. They also warn investors to keep in mind that the profitability of the commercial airline industry has historically been linked with the economy and therefore long-term gains and stability are uncertain.

2016 Comercial Aviation: Aircraft Financing Looking Strong

Boeing, in their Current Aircraft Finance Market Outlook 2016, sees the coming year as being a strong one for financing new commercial aircraft. The report projects “that the industry will provide funding for approximately $127 billion in new commercial aircraft deliveries.” The report, like IATA, also acknowledges the weak cargo market, but sees the long-term outlook for this category improving as developing economies continue to grow and Sixth Freedom carriers expand their networks. (“Sixth Freedom” refers to the ability of a carrier to transport cargo or passengers between two countries, while stopping in its own country in between.)

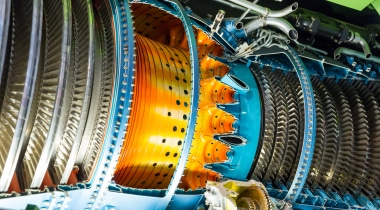

Aviation Efficiency

The spotlight was turned on the aviation industry during the Paris Climate Talks last December when mention of the aviation industry was omitted from the U.N. deal, which, the New York Times reports, “commit[s] nearly every country to lowering planet-warming greenhouse gas emissions to help stave off the most drastic effects of climate change.” Currently, the aviation industry is responsible for the output of 5% of global emissions, and Reuters provides numbers from the European Commission that estimate – if left unchecked, the aviation industry will be responsible for a third of all global emissions by 2020.

We reported back in August on the ways in which the aviation industry is working to improve its processes and products in order to reduce its emissions output. From more lightweight designs to electric planes and bio diesel, the industry is turning its sights toward efficiency.

The IATA has also laid out some efficiency targets, which include fuel efficiency improvements of 1.5% per year from 2009 to 2020 and a reduction of net CO2 emissions of 50% by 2020 (as compared to 2005 levels). Of course, these are targets and not mandates; therefore, there is no legal obligation to meet these goals. However, the International Civil Aviation Organization (ICAO) Committee on Aviation Environmental Protection (CAEP) is meeting this month to “finalize a number of key developments, including recommendations for new aircraft CO2 and non-volatile particulate matter (nvPM) standards.” These measures will be up for final review and adoption sometime in 2016.

Wrap-up

2016 is shaping up to be a good year filled with expansion, profit and movement toward creating higher efficiency standards. We look forward to sharing this year’s new industry developments with you.